Beyond Bank has recently received reports of scammers impersonating us, including spoofing our contact phone numbers.

Scammers are getting more sophisticated and creative in the methods they use to deceive victims into revealing their personal or financial information or to get them to transfer money.

Beyond Bank has received reports of ‘spoofing’ scams, which sees predators impersonate legitimate Beyond Bank phone numbers in both SMS and voice calls.

This means scammers can send messages that appear in the same thread as a legitimate text message sent by Beyond Bank. It may also appear that a scammer is calling from a legitimate Beyond Bank phone number.

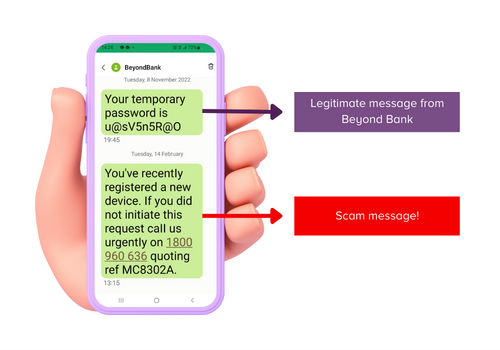

See the below image for an example text message a Beyond Bank customer has received:

Notice the urgent tone the scammer uses in the second message.

Scammers will often ask you to return a call or act ‘urgently’. This is a common tactic scammers use to frighten you into responding to their request quickly and without thinking. The best thing you can do is stop and take a breath. Then, visit the Beyond Bank website to find our official phone number to contact us. Never call a number from a text message.

How can you protect yourself from a ‘spoofing’ scam?

Never provide personal or financial information, passwords or banking codes, especially to anyone who contacts you by phone or SMS.

If you receive a request to call us, always look up our phone number listed on our contact us page to ensure that you are calling Beyond Bank.

Even if you suspect it’s a legitimate call from Beyond Bank, you should still inform the staff member that you’ll call them back via the phone number listed on our website.

Scammers are becoming advanced in their techniques so it’s important you remain vigilant to protect yourself from being scammed.

Here are some more ways you can protect yourself and your information:

- beware of unsolicited requests to transfer money to an unknown account. Always verify that the person is who they say they are - whether it’s your bank or your mum. To be extra cautious, call the person or relevant organisation back on their official contact details.

- change your passwords regularly for online banking, email accounts or other websites or apps that you make payments from

- enable two-factor authentication for all accounts, online banking and websites or apps where payments are made from.

- secure all your devices and regularly monitor your bank account for unusual activity, especially transactions.

- report unauthorised activity to the ACCC’s Scamwatch

- if you believe you have been scammed, please call us on the phone number listed on our Contact Us page.