What is round2save?

round2save works by rounding up each VISA Debit card transaction¹ you make on your nominated transaction account² to the nearest whole dollar, and transferring the rounded up amount to your nominated savings account.

For example, if you were to use your card to purchase an item for $23.54, then 46 cents would be automatically transferred to your nominated savings account once the transaction has cleared³

Why round2save?

How does it work?

round2save works by rounding up each Visa Debit card transaction¹ you make on your nominated transaction account² to the nearest whole dollar, and transferring the rounded up amount to your nominated savings account.

For example, if you were to use your card to purchase an item for $23.54, then 46 cents would be automatically transferred to your nominated savings account once the transaction has cleared³.

Check out the table example below to see what a regular day worth of spending and saving could look like.

| Purchase amount | Rounded up | Amount sent to your chosen account | |

| Groceries | $19.23 | $20.00 | $0.77 |

| Coffee | $4.70 | $5.00 | $0.30 |

| Petrol | $51.25 | $52.00 | $0.75 |

| Total Savings: | $1.82 |

Getting started is easy.

round2save FAQs.

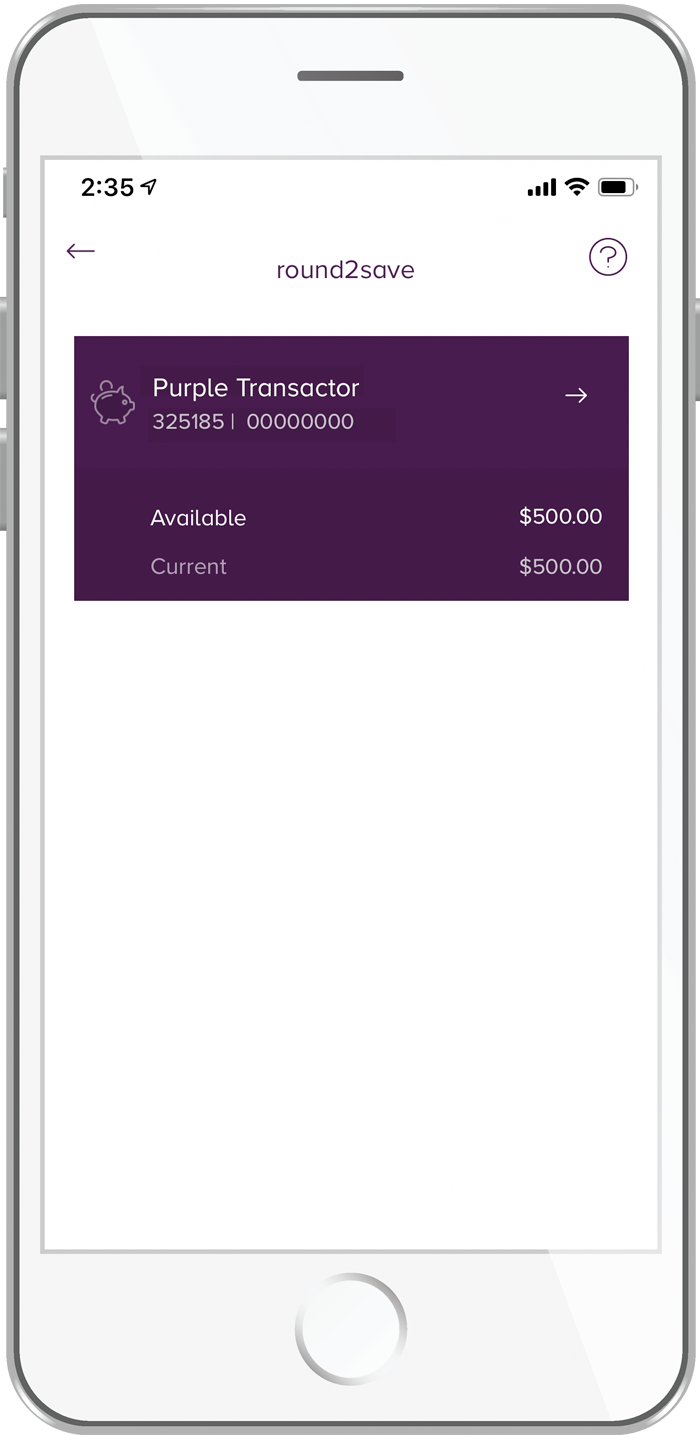

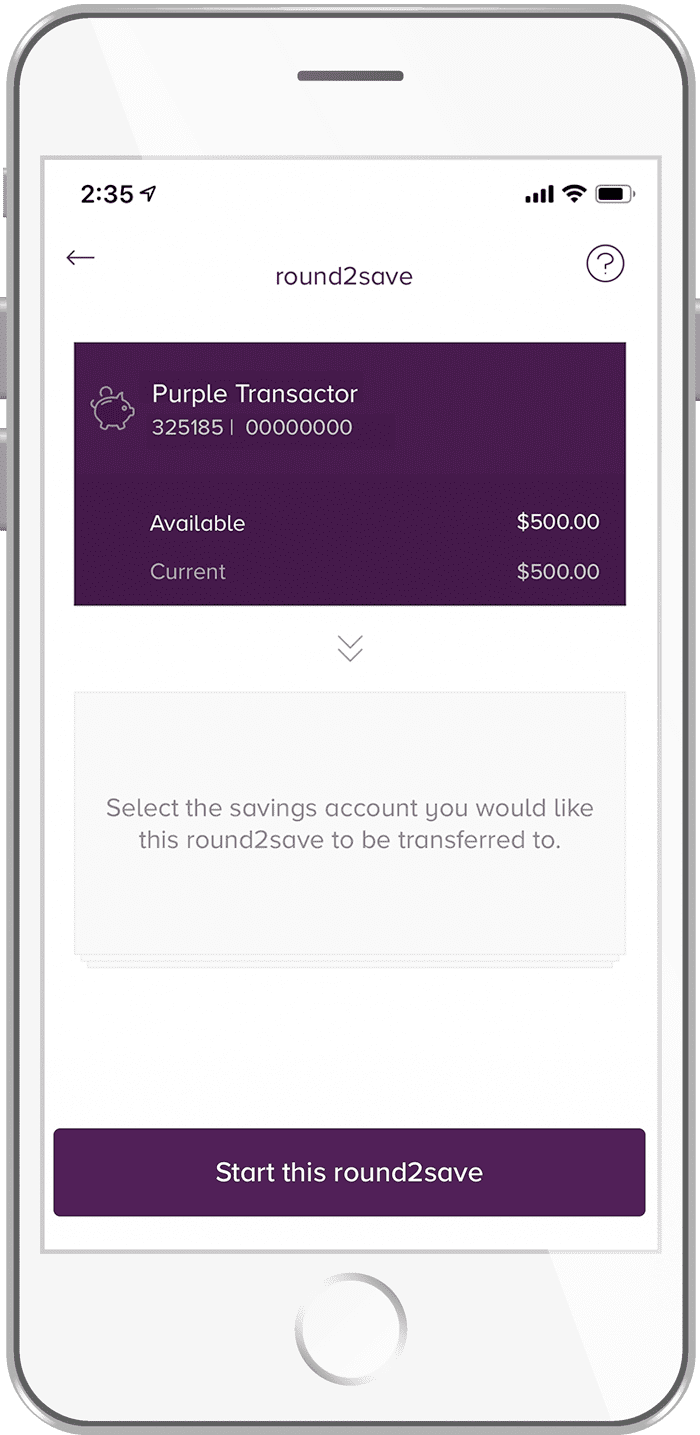

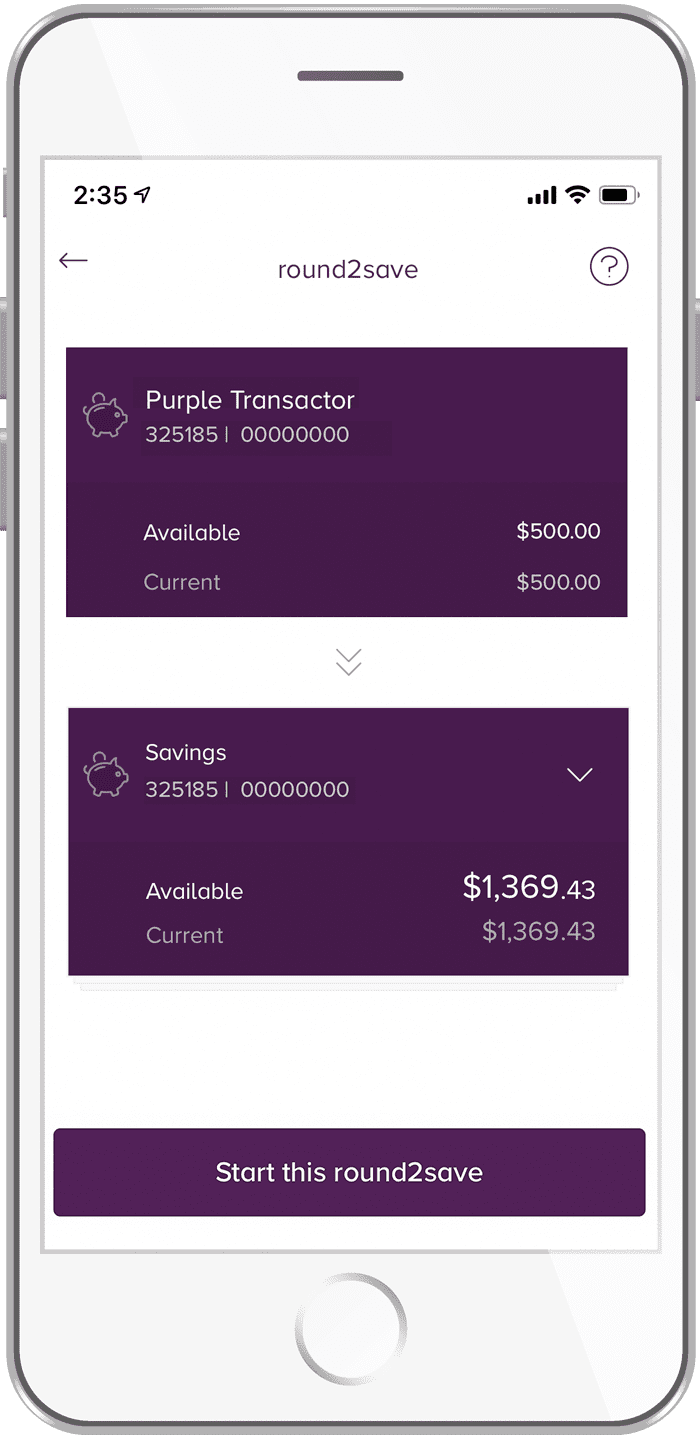

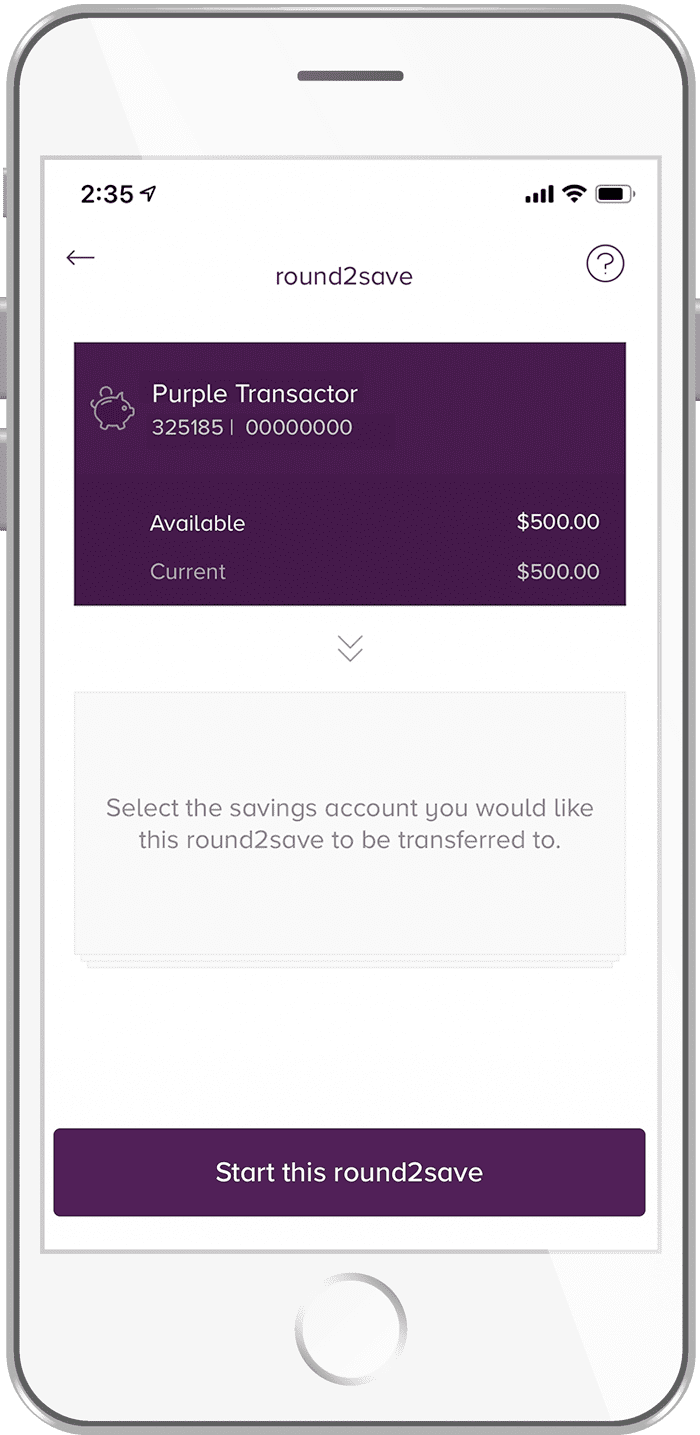

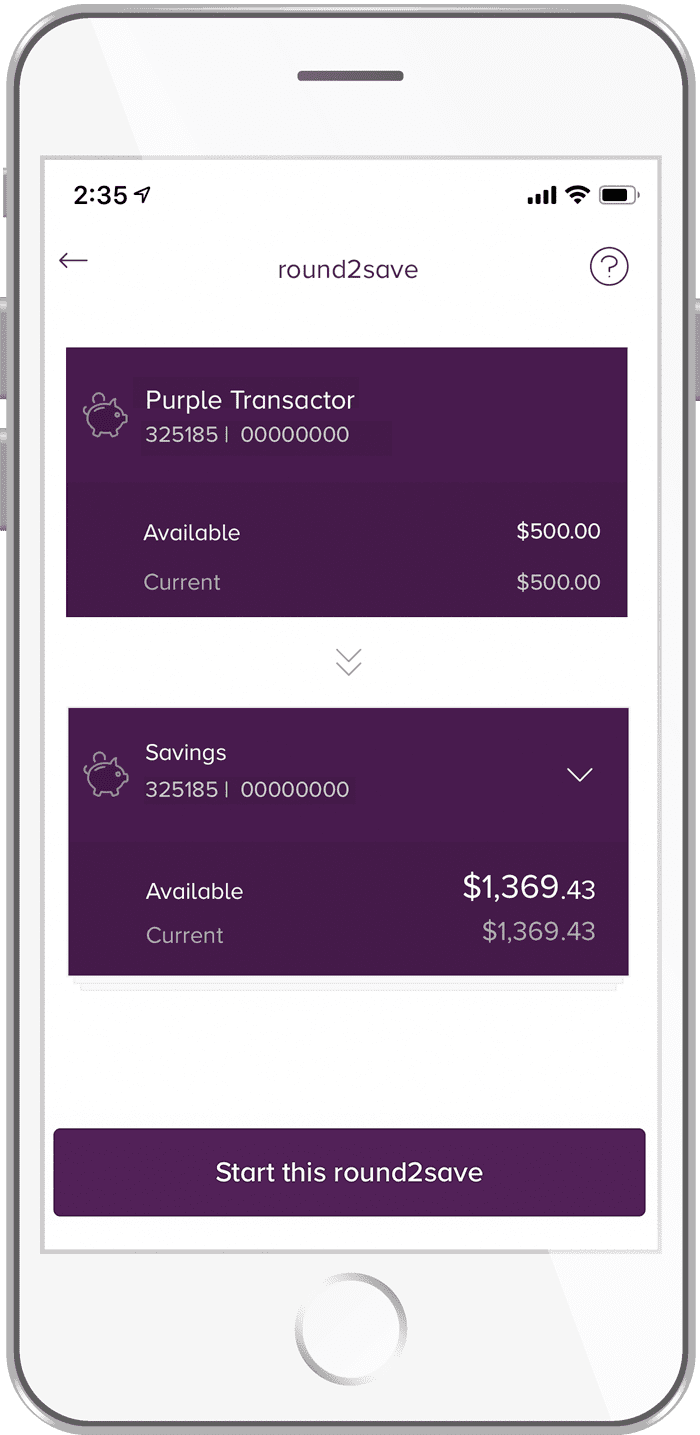

To enable round to save follow these steps:

1. Log in in the mobile app.

2. Go to Accounts and select a transaction account that you would like to enable round2save on.

3. Select a savings account that you would like to deposit your round2save earnings in.

4. Start transacting using your VISA Debit card and watch your savings grow!

round2save can be activated in our Mobile Banking App, but not via Internet Banking.

Currently no. However, this feature may be introduced in the future if enough interest is generated.

round2save will not work on accounts with more than one signatory.

Any cash withdrawals via ATM (including international ATM cash withdrawals) are subject to round2save rounding up, should the final transaction value not be a round figure. For example, if you were to withdraw money from an ATM overseas, due to the exchange rate it is likely that the transaction amount would not be a round figure, in which case the round2save amount would be transferred to your nominated savings account.

Download our award-winning Mobile App and bank on the go.

Still have questions?

Please read this important information.

| * | Awarded Canstar Customer-Owned Bank of the Year for Digital Banking from 2015-2024. |

| 1 | Only available on eligible Visa Debit card transactions, including point-of-sale and online purchases. round2save does not apply to Osko payments, BPAY or Direct Debit transactions. |

| 2 | Only available on eligible transaction accounts. |

| 3 | The transferred round2save amount may take up to 5 business days to appear in your savings account due to VISA pending transactions. |

| Terms, conditions, lending criteria, fees and charges apply. For full details please review our Financial Services Guide, Product Guide, Fees and Charges Guide and Target Market Determinations. These are available on our website at beyondbank.com.au/about-us/corporate-governance/disclosures, by calling us on 13 25 85 to request a copy or by visiting a branch. They will also be provided at the time of acquiring any product. | |

| This information is of a general nature only and does not take into consideration your objectives, financial situation or needs. The information must not be relied upon as financial product advice. Before acquiring any product you should read the relevant guides, Product Disclosure Document, and consider whether a product is suitable for your circumstances to decide if a product is right for you. |