Why is a personal budget important?

Let’s face it, the idea of setting up a budget can seem overwhelming and even a little tedious. However, it is well worth the effort as a budget can help you stay ahead of your bills, save for a future goal or weather unexpected events.

We are here to help make budgeting easier with our ‘do-it’ yourself’ budget planner.

First, let’s get an idea of the following:

Start budgeting!

Our Budget Planner will help you create a budget based on your earnings, spending and savings.

Enter all your details and the budget planner will calculate your result and give you your current financial position.

Let’s review your financial position.

Now you’ve calculated your Budget to understand your current financial position.

How do you know what a ‘good’ budget looks like?

One easy way is to see what percentages you are using on spending and savings by using the 50/30/20 rule:

- The basic idea is that you use fifty per cent of your salary on your life necessities or needs such as your food, mortgage, rent, transport and bills.

- Thirty per cent is for your wants, those unnecessary but fun things we all need to make life enjoyable e.g. clothing, holidays, going out.

- The last twenty per cent is used for debt payments, retirement planning and savings.

Of course, you can adjust the percentages to tailor to suit your current circumstance.

Think about whether you could make any savings in your non-fixed costs. These are costs that vary from time to time like shopping, groceries or going out.

Add these small savings to any leftover funds after your regular bills have been paid to contribute towards a savings goal.

Do you need help setting up a budget?

Know where your money is going.

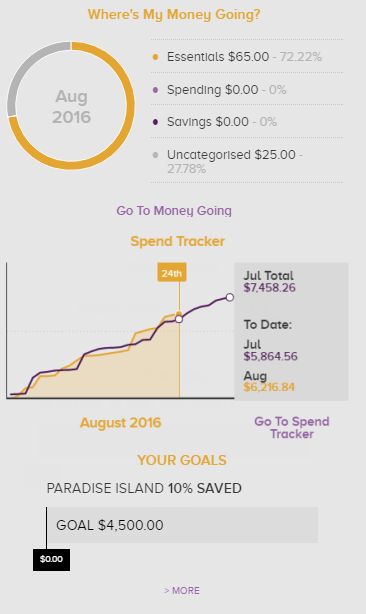

With our Beyond Finance Manager in Internet Banking, you can set up a savings goal and categorise your expenses, that way you know where your money is going and compare between different months.

Beyond Finance Manager enables you to see your budget visually within Internet Banking using categories such as;

- Transport,

- Rent & bills,

- Groceries,

- Eating out,

- Loans,

- Insurance, and more!

Managing your money is made easy because all your expenses and income are automatically categorised.

You can also set up goals. Whether you are saving for a holiday, car, house, or just saving. Simply include your goal amount, date you would like to achieve your goal by and set up your payments and Goals will show you what you need to do to achieve it and then track your progress.

You might also like...

This information is of a general educational nature only and does not take into consideration the objectives, financial situation or needs of the reader. The information must not be relied upon as financial product advice. You should consider whether any of the products mentioned or suggestions offered are suitable for your circumstances before acquiring or acting on them. Beyond Bank Australia Ltd ABN 15 087 651 143 AFSL/Australian Credit Licence 237 856. © 2020.