Quick links to common FAQs.

All Account FAQs.

round2save can be activated in our Mobile Banking App, but not via Internet Banking.

round2save will not work on accounts with more than one signatory.

The following transaction types will not round2save:

- BPAY® Payments

- Fee transactions

- Transfers between accounts

- Osko Payments

Any cash withdrawals via ATM (including international ATM cash withdrawals) are subject to round2save rounding up, should the final transaction value not be a round figure. For example, if you were to withdraw money from an ATM overseas, due to the exchange rate it is likely that the transaction amount would not be a round figure, in which case the round2save amount would be transferred to your nominated savings account.

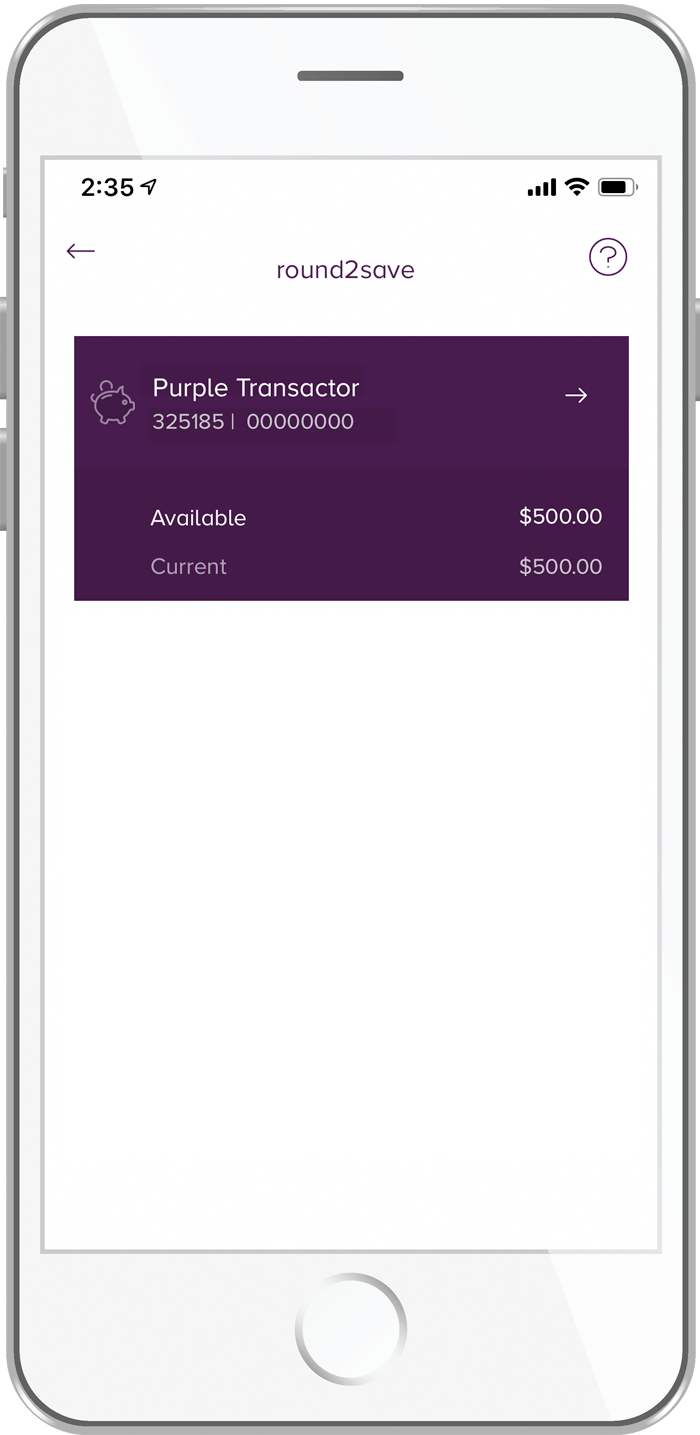

Accounts available for the origin (transaction) account include:

- Purple Transactor

- Access Savings Account

- BU Account.

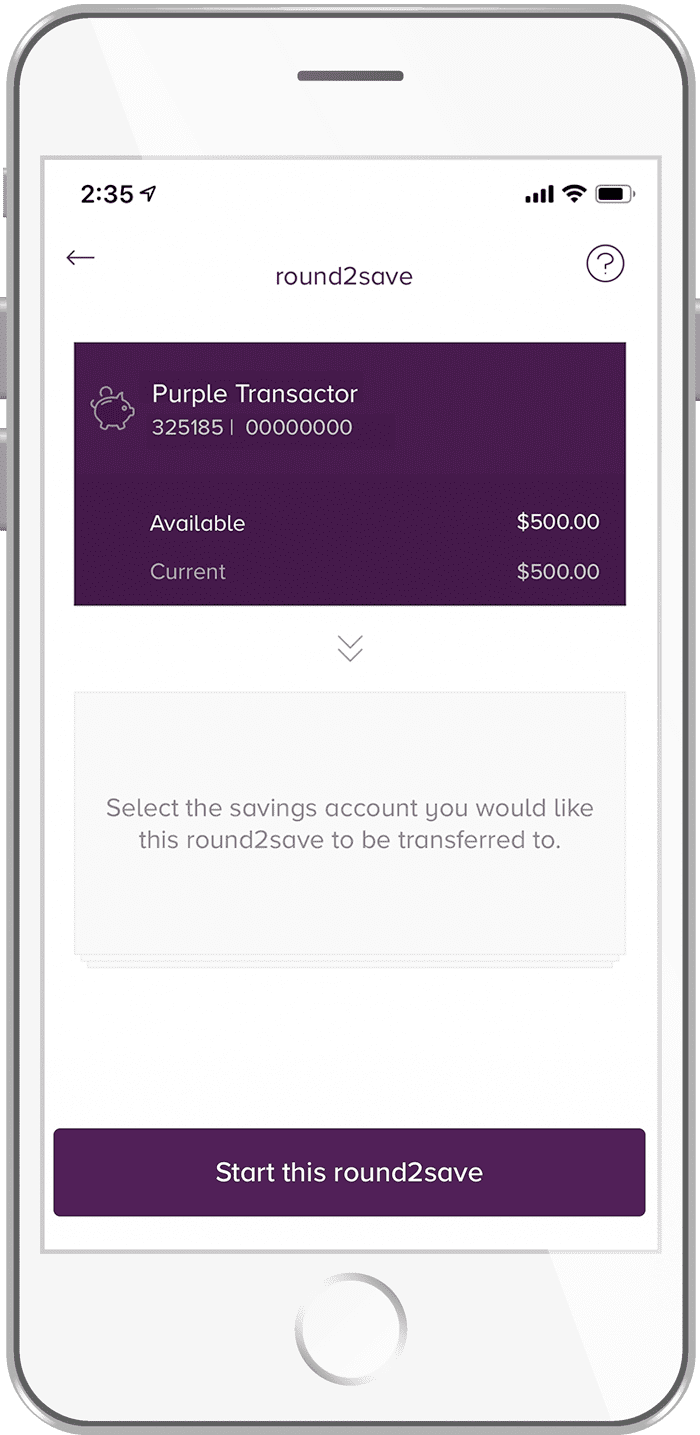

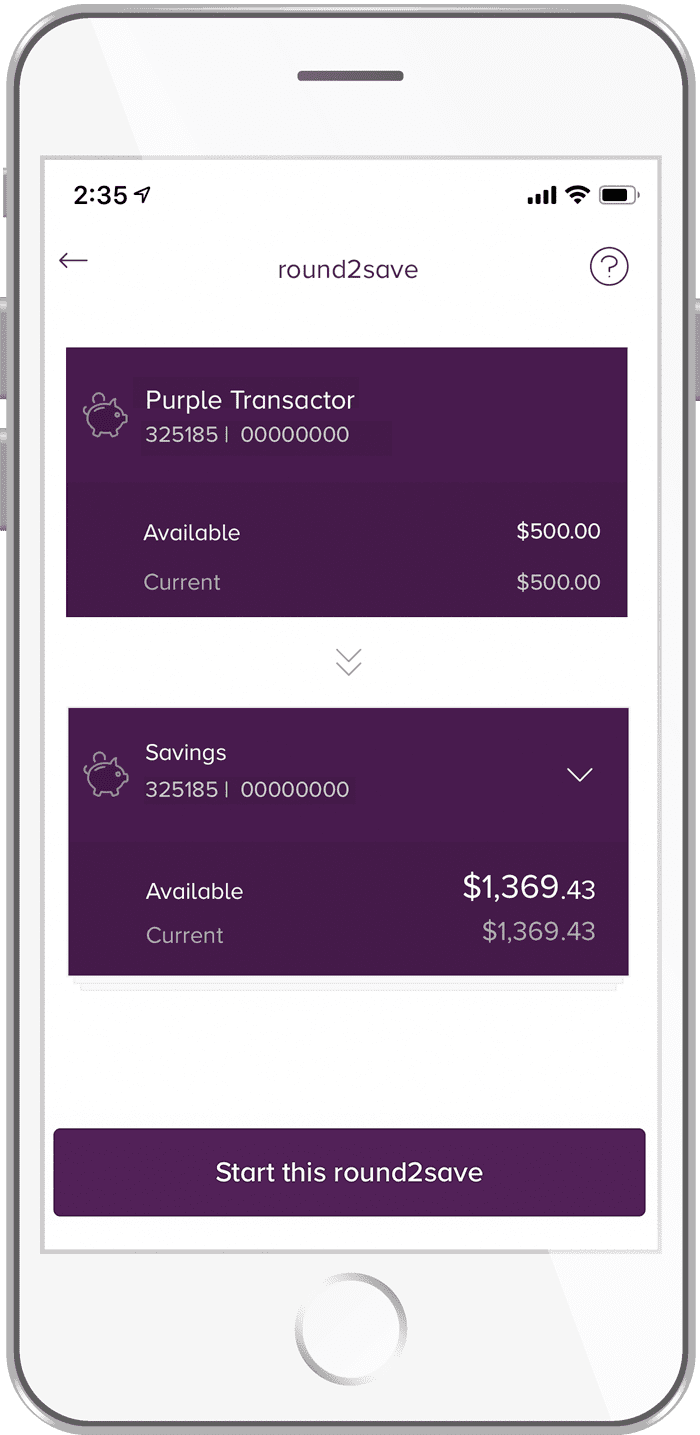

Accounts preferred for the landing (savings) account include:

- Bonus Saver Account

- monEsaver Internet Savings Account

- Community Reward Account.

round2save works by rounding up each transaction¹ you make on your nominated transaction account² to the nearest whole dollar, and transferring the rounded up amount to your nominated savings account.

For example, if you were to use your card to purchase an item for $23.54, then 46 cents would be automatically transferred to your nominated savings account once the transaction has cleared³.

¹Only available on eligible VISA Debit card transactions, including point-of-sale and online purchases. round2save does not apply to Osko payments, BPAY or Direct Debit transactions.

²Only available on eligible transaction accounts.

³The transferred round2save amount may take up to 5 business days to appear in your savings account due to VISA pending transactions.

To enable round to save follow these steps:

1. Log in in the mobile app.

2. Go to Accounts and select a transaction account that you would like to enable round2save on.

3. Select a savings account that you would like to deposit your round2save earnings in.

4. Start transacting using your VISA Debit card and watch your savings grow!

Currently no. However, this feature may be introduced in the future if enough interest is generated.

Our BSB is 325 185. This is a unified BSB, so applies to all accounts held with Beyond Bank regardless of which branch you set the account up through.

If you are setting up a new payment, we would like you to use the BSB 325 185.

What you need to do

You need to use this BSB for direct debit and direct credit arrangements.

- Direct debits may include payments you make, such as insurance premiums, utility bills, gym memberships, and council rates.

- Direct credits may include payments you receive such as salary, dividends, Pay Anyone transfers, Medicare, tax or social security.

If you are setting up a new direct debit or direct credit payment, you will need to provide the following details:

- BSB number: 325 185

- Institution: Beyond Bank Australia

- Your Account Number.

Many third parties will allow you to update your banking details through your online account. Alternatively, you can phone or write to them using our handy letter template so they can update the details for you.

Click here to download our template letter to notify anyone crediting or debiting your accounts of a change in your banking details.

You may cancel a direct debit at any time by notifying us on 13 25 85 or visiting one of our branches. We would encourage you to notify the debiting institution of your request to cancel the direct debit.

The cancellation of direct debit received on the same day a direct debit is scheduled will not take effect until the next business day.

Once notified of the cancellation, we can stop any further payments from being made.

When you make a purchase using your Visa the merchant will send an authorisation request to process the transaction. This authorisation request places a hold on the funds to ensure there will be sufficient money in your account to complete the transaction.

The funds will be on hold for up to five business days, during which time the transaction will be finalised. Once complete the funds will be debited from your account balance and the merchant information will be displayed in your transaction history.

There is nothing that you need to do, the payment will automatically be completed or released by the merchant or will be automatically removed after five business days if this has not happened.

Useful links

Noticed an unfamiliar transaction on your account or statement?

If you have a transaction on your account that you are not sure about there are a couple of things you can check before disputing a transaction:

- Most merchants will have their company name listed on your transaction listing and statement instead of their trading name. If you do a quick search generally you should be able to find the business name

- Some card transactions will appear a few days after you have completed the transaction

- Use the list at the bottom of this page to help identify some common retailer/business names and subscription providers.

Need to dispute a transaction?

If you are wishing to dispute a transaction you do not recognise, please contact us on 13 25 85 or send a Secure Message via Internet Banking or the Mobile App. You will be required to provide us with the following details:

- date of the transaction,

- the amount of transaction, and

- the merchant name.

We recommend keeping any EFTPOS or email receipts, as sometimes transactions will show the name of the parent organisation rather than the trading name.

Need to block a payment?

If you notice an unrecognised charge on your account, you can temporarily block your card.

Go to your Mobile App, and navigate to

- Menu > Settings > Cards > select your card > Lock

Go to Internet Banking, and navigate to

- Services > Card Management > complete the two-factor authorisation (secure code) > toggle the Block option to on

Alternatively, contact us on 13 25 85. If it is a fraudulent transaction, we would need to cancel your card and organise a replacement. Unfortunately, we cannot block a merchant from taking funds from your card.

For assistance outside of our contact centre hours, our card monitoring team are able to be reached 24 hours a day to assist with cancelling your card for you on 1300 705 750.

Need to cancel a transaction?

Unfortunately, we cannot cancel a charge that is on hold or has debited from your account. If a charge is on hold you will need to contact the merchant to request they reverse the charge. If the charge has been debited, please call us on 13 25 85, or send a Secure Message via Internet Banking or the Mobile App to raise a dispute. We will require:

- the date of the transaction,

- the amount of transaction, and

- the merchant name.

We recommend contacting the merchant by email so that there is written evidence if you need to dispute the charge.

Sent money to the wrong credit card and need to get it back?

Please contact us on 13 25 85 or send a Secure Message via Internet Banking or the Mobile App so we can raise a recall of funds. We will require

- the date of the transaction,

- the amount of transaction,

- the account number/card number you paid, and

- the correct account number/card number.

Need to stop a direct debit?

You would need to notify the merchant of your intention to cancel in the first instance. If they continue to debit you after you have cancelled, we can block any further direct debits if you contact us directly on 13 25 85, or send a Secure Message via Internet Banking or the Mobile App. We highly recommend cancelling directly through the merchant, as some vendors may charge a fee for late or dishonoured payments.

| Trading Name (Alphabetical Order) | Description |

| ACADEMICSINGLES* | A subscription service for online dating |

| ACM*BRINKLEYDAY.COM* | Online merchant that offers a trial subscription service for cosmetic products |

| APPLE ITUNES | Purchases made on the app store for an Apple device |

| AVG INTERNET SECURITY* | A subscription for anti-virus software (may auto-renew) |

| BLS*BRINKLEYNIGHT.COM* | Online merchant that offers a trial subscription service for cosmetic products |

| EHARMONY.COM.AU* | A subscription service for online dating |

| ESERVICEPS.COM* | Online merchant that offers a trial subscription service for pharmaceutical products |

| GETHELPSXPF.COM* | Online merchant that offers a trial subscription service for pharmaceutical products |

| GOOGLE *Play g.co/helppay | A purchase made through the Google Play store |

| HELPDESKSC.COM* | Online merchant that offers a trial subscription service for pharmaceutical products |

| INFODESKCS.COM* | Online merchant that offers a trial subscription service for pharmaceutical products |

| JUST ANSWER* | Online subscription service for expert advice |

| MCAFEE* | A subscription for anti-virus software (may auto-renew) |

| NORTON* | A subscription for anti-virus software (may auto-renew) |

| ONLINEORDEROHC.COM* | Online merchant that offers a trial subscription service for pharmaceutical products |

| PAYREF.INFO* | A subscription service for online dating |

| PAYPAL | A online payment processed by paypal, the merchant may differ such as Ebay |

| PLAYSTATIONNETWORK | An online gaming purchase for a Playstation device |

| pof.com* | A subscription service for online dating |

| RGPCUSTOMER.COM* | Online merchant that offers a trial subscription service for pharmaceutical products |

| SPOTIFY* | A subscription for online music streaming |

| SUPPORTPSERV.COM* | Online merchant that offers a trial subscription service for pharmaceutical products |

| VENNTRO MEDIA GROUP* | A subscription service for online dating |

| VIAGOGO | An online ticket re-sale website |

*Note: this merchant offers a trial subscription service, they may be automatically charging ongoing subscription fees unless cancelled following an initial trial period

If you are still uncertain, or the transaction does not reflect any of the names in the table above, please send us a secure message via internet banking or the mobile app with details of the transaction.

If you need to dispute an unauthorised transaction, please send us a secure message via Internet Banking or the Mobile App with details of the transaction. Alternatively, you can call us on 13 25 85 or visit your nearest branch.

We may be required to cancel your card to prevent further financial loss.

A pending transaction can only be cancelled if the merchant provides us with a pre-authorisation release confirming they have no intention to debit the restricted funds. As the merchant has authorisation over the funds, we cannot release the funds without their authority.

If you believe a pending transaction is unauthorised, once the funds have debited from your account, we can help you dispute the transaction. Please send us a secure message via internet banking or the mobile app with details of the transaction. Alternatively, you can call us on 13 25 85 or visit your nearest branch.

Transfers made using a PayID or from one Beyond Bank account to another will be processed instantly and the funds will be available within seconds.

For transfers made on a public holiday or weekend, using BPAY or a BSB and account number, the funds will be debited from your account immediately, processed the next business day and will be available to the biller or recipient within 1-2 business days.

Visa transactions can take up to 5 business days to process. During this time the funds will be on hold while the transaction is being finalised. Once complete the funds will be debited from your account balance and the merchant information will be displayed in your transaction history.

Some online merchants will verify your card details by processing a separate pre-authorisation amount (the dollar values can vary), prior to processing the purchase transaction. Usually after the transaction is complete the separate pending transaction and funds will be released within five business days.

If the merchant has processed a separate pre-authorisation amount and you would like the funds to be released before the five business days, particularly if the pending amount is of higher value, the merchant can provide us with a pre-authorisation release confirming they have no intention to debit the restricted funds.

Pending transactions will be deducted from your ‘available balance’ immediately, however, the amount will not be deducted from your ‘account balance’ until the transaction process is complete (which can take up to five business days).

Between Beyond Bank accounts

Transfers between your own accounts and to most other Beyond Bank accounts are instant.

To other financial institutions

Transfers to other Australian financial institutions are available within seconds*, if transferred using a PayID. For transfers made using a BSB and account number, the funds will be available in the recipient’s account within 1-2 business days.

* Faster transfers available between participating banks, a full list of participating banks is available here.

International Money Transfers (IMT)

It usually takes 2-5 business days to process an IMT, however it can take longer for the recipient to receive the funds depending on the country and bank the funds are being sent to.

The standard transfer limits for personal and business accounts in Internet Banking are:

- Between Beyond Bank accounts - $5,000

- To other financial institutions - $5,000

- BPay transfers - $10,000

You can increase your own limit for these transaction types in Internet Banking or the Mobile app using the steps here.

Your standard daily limit for International Transfers is the equivalent of $5,000 Australian Dollars, converted into the destination currency. If you need to transfer greater than $5,000 or send the payment in Australian Dollars as an International Transfer, please call us on 13 25 85.

The standard transfer limits for personal and business accounts in the Mobile App are:

- Between Beyond Bank accounts - $5,000

- To other financial institutions - $5,000

- BPay transfers - $10,000

Once logged into Internet Banking, your daily transfer limits can be increased or decreased via the Security > Transaction Limits menu. If you wish to increase any of your daily transfer limits above $20,000 you will need to contact us via secure message, call us on 13 25 85 or visit your nearest branch.

Once logged into the Mobile App, your daily transfer limits can be increased or decreased via the Settings > Transaction Limits menu. If you wish to increase any of your daily transfer limits above $20,000 you will need to contact us via secure message, call us on 13 25 85 or visit your nearest branch.

Transfers:

Contact the recipient and ask them to transfer the funds back to you.

If the account details you provided are incorrect, the funds may be returned to your account automatically by the other bank in 1-4 business days. Please note, some financial institutions have unique account numbers and therefore do not check BSB/account number combinations.

If after 1-4 business days the funds have not been returned to your account, contact us via secure message, call us on 13 25 85 or visit your nearest branch and we can attempt a recovery of the funds.

This process can take several weeks as we need to wait on a response from the other financial institution. We will send you a letter providing details of the outcome once the recovery process has been completed.

BPAY:

If you have only just completed a BPAY and realised the information was incorrect, contact us straight away on 13 25 85. In some instances, we may be able to reverse the transfer for you.

If some time has passed since you completed a BPAY with incorrect information, there is a possibility that the biller may reject the payment and return the funds. This process can take around 2-4 business days. Contact the biller directly to advise them of the situation.

If after 4 business days, the money has not been returned to your account, we can help you dispute the payment. To dispute an BPAY transaction, please send us a secure message via internet banking or the mobile app with details of the transaction. Alternatively, you can call us on 13 25 85 or visit your nearest branch.

A biller will receive your BPAY payment approximately 1-2 business days after your complete the transfer.

Yes, existing customers can open a variety of transaction and savings accounts via the Open Account menu in the Mobile App.

An opening deposit will be required at the time a new account is opened via the Mobile App. However, this can be a small deposit as little as $1.

Cash deposits can be made into your account at your nearest branch or by using the Bank@Post service at participating Australia Post locations (fees may apply, view our Fees & Charges guide for details).

Cheque deposits can be made in a branch, by posting them to us at GPO BOX 1430, Adelaide SA 5001, or for cheques issued to you in your name, these can also be deposited using the Bank@Post service (Bank@Post is unfortunately not able to be used for cheques in joint names or in the name of a business account). Please note that cheque deposits in a branch can take up to 5 business days to clear into your account, for cheque deposits via Australia Post this can be up to 8 business days. The time frame if a cheque is mailed to us may be longer depending on when the cheque is received in the mail.

Alternatively, online transfers to your account can be made from other financial institutions using your registered PayID for instant* access or with your BSB and account number for access within 1-2 business days.

If you have coins to deposit these can be taken into a branch bagged in denomination lots and can be deposited for you. Alternatively, some of our branches have coin counting machines that can automatically count the coins for you for deposit. To check if your nearest branch has a coin counter please contact them via the contact details here.

* Faster transfers are available between participating banks. A full list of participating banks is available here

Cash withdrawals can be made from your account at your nearest branch. Alternatively, online transfers from your account can be made via the transfer menu option in Internet Banking or the Mobile App.

Transaction accounts will receive either an eStatement or paper statement every six months, unless you have requested to receive a more frequent account statement.

If you have a loan or credit card product, you will receive a monthly eStatement or paper statement.

To change the name on your account you must provide us with an original or certified copy of your change of name documentation, along with identification showing your current name.

You will need to visit your nearest branch with the documentation to request the change of name. If you do not live near one of our branches, please call us on 13 25 85 for further assistance.

You can set up reoccuring scheduled transfers between your own accounts using Internet Banking or the Mobile App.

Internet Banking:

- Once logged in, select Transfer/Pay > Transfer

- Choose the accounts you wish to transfer from and to

- Enter the transfer amount and any reference

- Select Schedule Payments (located under the transfer amount)

- Enter the information based on your desired transfer frequency.

Mobile App:

- Once logged in, select Pay > Transfer

- Choose the accounts you wish to transfer from and to

- Enter the transfer amount

- Set your schedule by clicking the calendar icon in the top right of the amount screen

- Enter the information based on your desired transfer frequency.

You can also set up reoccurring scheduled transfers to accounts outside of Beyond Bank using Internet Banking or the Mobile App.

Internet Banking:

- Once logged in, select Transfer/Pay > Make Payment

- Select the Schedule button

- Enter account details using New Payee or select from your list of Saved Payees

- Once the payee information is entered, choose the amount and desired transfer frequency.

Mobile App:

- Once logged in, select Pay > Make Payment

- Enter account details using New Payee or select from your list of Saved Payees

- Enter the transfer amount

- Set your schedule by clicking the calendar icon in the top right of the amount screen

- Enter the information based on your desired transfer frequency.

Please note that reoccurring payments to other banks is currently only available with BSB and Account Number, payments using PayID are unfortunately not able to be scheduled at the present time.

You can view your account balance at any time by logging into Internet Banking or the Mobile App and selecting the Accounts menu option.

Alternatively, you can call our Account Information Line or Customer Relationship Centre on 13 25 85 with your Telephone Banking Passcode.

Yes, you can start an application and save and resume at a later time if necessary. Once you save the application you will be sent a confirmation email and a loan application reference number. You will need this information to resume the application.

A member number is a unique number that identifies you from all other Beyond Bank customers. When you open a membership with Beyond Bank you will be allocated a member number and within your membership various accounts, products and services can be opened.

You can find this on the bottom of a Beyond Bank card below your name, on the front page of your statement or our team can provide it for you in a branch or by phone on 13 25 85.

Fees and charges will vary from depending on the accounts you own.

For example, our Purple Transactor account has $0 monthly fee, $0 fees for card transactions in Australia and $0 dishonour fees.

However, other accounts like our Retirement account may incur fees which will be offset by your monthly fee allowance. Your monthly fee allowance is based on your relationship portfolio value and the number of years you have been a member.

For a full explanation of all of the fees charged by Beyond Bank, please see our Fees and Charges guide.

A transaction account is an account that you use on a day to day basis which your wage and other payments can be paid into. Your transaction account is also used to pay for bills, shopping and other everyday purchases using a linked Visa card. Transaction accounts do not earn interest on the balances.

A savings account is an account that earns and pays interest based on your overall balance, providing any terms and conditions of the account are met. Whilst your money is not locked away like a term deposit, a savings account is intended to help you reach your savings goals faster, so you would not have a Visa card or direct debit linked to a savings account.

A Community Reward account is an interest earning savings account where the more you save, the more we will donate to your favourite community group or charity – at no cost to you.

Useful links

Existing members can open a Community Reward Account through Internet Banking or the Mobile App. New members can open an account online, by visiting your nearest branch or by calling us on 13 25 85 for more information. New members will need either a Drivers Licence or an Australian Passport, or a Birth Certificate and either a Medicare Card or Student Photo ID (if full-time student) to open a new account.

A Term Deposit is a great account for customers wanting to earn a higher return on their investment and won’t need to access the funds during the investment term. The interest rate is fixed for a set period of time, ranging from three months to five years, with the choice of interest paid at maturity for terms under 12 months or interest paid monthly, annually or at maturity for terms over 12 months.

Useful links

Existing members can open a Term Deposit account through Internet Banking or the Mobile App. New memberships can be opened online, by visiting your nearest branch or by calling us on 13 25 85 for more information. New members will need either a Drivers Licence or an Australian Passport, or a Birth Certificate and either a Medicare Card or Student Photo ID (if full time student) to open a new account.

The Retirement Account is an interest earning and everyday transaction account rolled into one. Whether it be buying coffee or dinner with your Visa card, receiving your pension or other payments, sending money in an instant^ with PayID or paying your bills through BPAY or direct debits - this account can do it all.

To be eligible to open a Retirement Account you must receive a superannuation pension, be a self-funded retiree, an age pensioner or receive the Mature Age Allowance.

The Retirement Account has a stepped interest rate so the more you save, the more interest you earn. Fees are offset by your monthly fee allowance which is based on your relationship portfolio value and the number of years you have been a member. For further information refer to our Fees and Charges Guide.

Please read this important information.

| ^ | Faster transfers are available between participating banks, a full list of participating banks is available here. |

Existing members can open a Retirement Account account through Internet Banking or the Mobile App. New memberships can be opened online, by visiting your nearest branch or by calling us on 13 25 85 for more information. New members will need either a Drivers Licence or an Australian Passport, or a Birth Certificate and either a Medicare Card or Student Photo ID (if full time student) to open a new account.

The Purple Transactor is an account for everyday use with $0 monthly fee. Whether it be buying coffee or dinner with your Visa card, receiving your wage or other payments, sending money in an instant^ with PayID or paying your bills through BPAY or direct debits - this account can do it all.

Tap and go payments are easy with Visa payWave, Apple Pay¹, Google Pay² or Samsung Pay³. Plus, there are $0 fees for card transactions in Australia.

^ Faster transfers available between participating banks, a full list of participating banks is available here.

¹ Apple® is a trademark of Apple Inc. Apple Pay is available on select Apple devices. For a list of compatible Apple Pay devices, see https://support.apple.com/km207105

² AndroidTM and Google PayTM are trademarks of Google Inc. Google Pay is available on selected Android devices.

³ Samsung Pay is a trademark of Samsung Electronics Co. Ltd. Samsung Pay is available on select Samsung devices.

- Existing members can open a Purple Transactor account through Internet Banking or the Mobile App.

- New memberships can be opened online, by visiting your nearest branch or by calling us on 13 25 85 for more information.

- New members will need either a Drivers Licence, an Australian Passport or both a Medicare Card and an Australian Birth Certificate to open a new account online. For alternative identification options, please visit us in a branch.

Please note that you will not be able to make transfers to cryptocurrency platforms during the first 90 days after opening a new purple transactor account.

The Purple Transactor is a non-interest earning account with none of those annoying ‘everyday’ fees. There are $0 fees for card transactions in Australia, $0 monthly fees and $0 dishonour fees. Transactions are excluded from fee free are TEXT ME!*, International Transaction Fee and any SWIFT and Foreign Exchange Related Fees.

* TEXT ME! Fees are not inclusive of 2nd factor secure sms authentication messages. For a full explanation of all of the fees charged by Beyond Bank, please see our Fees and Charges guide.

Viewing your interest details is simple and secure in mobile and internet banking.

- Log in to Internet Banking

- Go to Accounts, then Interest Details

- Interest Details are displayed.

Or

- Log in to your Mobile App

- Go to Accounts, then locate your desired account

- Click Available/Current, then select Info

- Interest Details are displayed

Yes.

Please see our Fees and Charges booklet.

If you are wishing to dispute a transaction you do not recognise, please contact us on 13 25 85 or send a Secure Message via your Internet Banking or Mobile App.

You will be required to provide us with the following details: date of the transaction, the amount of transaction, and the merchant name. We recommend keeping any EFTPOS of email receipts, as sometimes transactions will show the name of the parent organization rather than the trading name.

If you notice an unrecognised charge on your account, you can temporarily block your card via Internet Banking (Services > Card Management > Secure Code > slide the tab next to Block Card) or Mobile App (Menu > Settings > Cards > press card icon > Lock) or contact us on 13 25 85 to discuss further.

If it is a fraudulent transaction, We would need to cancel your card and organise a replacement. Unfortunately, we cannot block a merchant from taking funds from your card.

Unfortunately, we cannot cancel a charge that is on hold or has debited from your account. If a charge is on hold you will need to contact the merchant to see if they can reverse the charge.

If the charge has been debited, please contact us on 13 25 85, or send a secure message to raise a dispute. We will require the date of the transaction, the amount of transaction, and the merchant name. We recommend contacting the merchant by email so that there is written evidence if you need to dispute the charge.

Beyond Bank has no planned closures of any branches across its national network.

In the event that opening hours are adjusted, we will let you know. Rest assured you can always access your money and make payments via Internet Banking or the Mobile App or via phone on 13 25 85.

Australia has one of the strongest banking systems in the world. You can have confidence that all Australian banking institutions must meet the toughest regulatory standards, designed to protect you.

As a Beyond Bank Australia customer, you are protected under the Australian Government’s Financial Claims Scheme, meaning your deposits are guaranteed to be repaid up to a limit of $250,000 for each account holder.

To find out more information, visit APRA’s financial claims scheme website.

If you think you have been scammed, start by calling us on 13 25 85 or visiting your local branch.

These sophisticated scams could include phishing emails and phone calls impersonating corporate and government entities.

Clicking on malicious links or visiting fake websites may automatically:

- install computer viruses or malware and ransomware onto your device

- giving cybercriminals the ability to steal your financial and personal information.

Please ignore any contact of this nature and do not, under any circumstances, provide your personal or financial details.

For more information about current scams, ways to protect yourself and more information about what to do if you believe a scam may have impacted you, please check our Scam page.

Please remain alert. Click here for more information.

Direct Debits – the debiting of funds from your account electronically by an external party through direct entry You can set up a direct debit by providing a service provider with your BSB and account number. You are able to cancel this authority by contacting the external party or Beyond Bank Australia.

Periodic Payment (recurring payment) – the automatic debiting of funds from your account electronically and sending of those funds to another account or an external party. You are able to cancel this authority by contacting Beyond Bank Australia.

Quick Debit – the electronic debiting of funds from your account to another financial institution and depositing these funds in an account with us. You are able to cancel this authority by contacting Beyond Bank Australia.

Recurring Visa Payment Authority – the regular automatic debiting of funds from your account electronically by an external party using your Visa Debit or Visa Credit card number, expiry date and 3-digit CVV number on the back of your card. You are able to cancel this authority by contacting the external party.

Generally speaking, we can fulfil requests of up to $3,000 in our branches without notice. For amounts over $3,000, we request a minimum of at least 1-2 business days' notice to allow us to ensure that we can have the additional funds available for you in the branch when you visit.

If your request is urgent, please call us on 13 25 85 or contact the branch directly, and we would be happy to try and assist with your urgent request where we are able.

In line with helping to keep your account safe and meeting regulatory requirements, you will require photo identification when visiting the branch for a cash withdrawal, and we may need to confirm additional details with you to be able to action your request.

You can find your member number either on the front of your Beyond Bank Access Card or at the top of the first page of your statements. If you use our Mobile Banking app, you can also find this in the menu when logged in under Useful Info > App Details.

If you do not have access to these options, our team can provide you with your member number in a branch or by phone on 13 25 85.

There is a great deal of change and uncertainty at the present time and this is causing concern about finances and their ongoing loan repayments. We are here to help you, for information about working through financial stress please click here for more information.