What is Parent Equity?

If you are looking to enter the property market but haven’t saved enough for a deposit, our Parent Equity option can help.

One of the biggest barriers you face when buying a house is saving for a deposit. With our Parent Equity option, a parent can 'guarantee' part of your loan by providing additional residential security (i.e. their own home) to alleviate the need for a deposit from you, usually around 20%2 of your total loan amount.

What does this mean for parents? It means that, by going guarantor with our Parent Equity option, parents can make buying a home more achievable for you.

Key features of Parent Equity:

Our Parent Equity option is especially useful if you’re a first home buyer, and can allow you to:

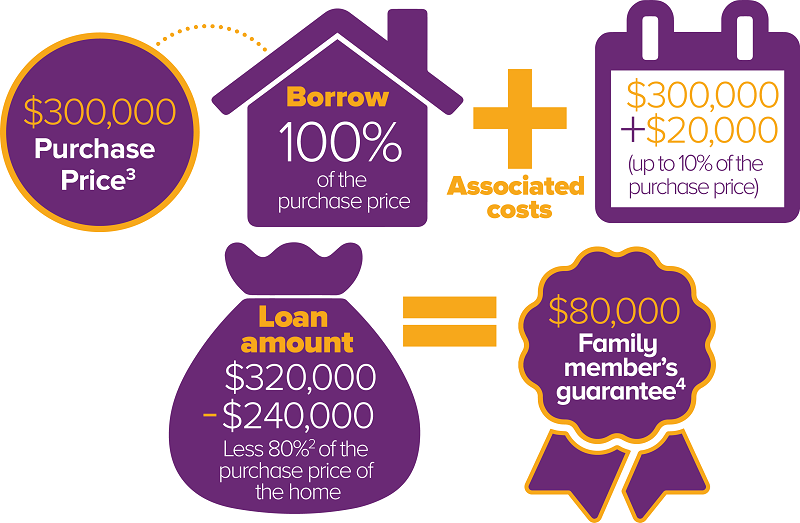

- borrow up to 100% of the purchase price of a property or of the combined land and building contract price when purchasing vacant land to build.2

- borrow up to an additional 10% of the purchase price to help with associated costs.

- avoid the additional expense of paying for Lenders Mortgage Insurance (LMI).

Have a look at this example.

We always encourage family members to obtain independent legal and financial advice before they agree to give guarantees in relation to home loans with a Parent Equity option.

We're here to help.

Prefer to talk to someone?

Our Lending Team are available to chat through any questions you have about the home loan journey.

Book a meet upUseful Links

Please read this important information.

| 1 | The guarantee and additional security must be provided by your parent(s), in-law(s) or step-parent(s). |

| 2 | Subject to the property location and licensed valuation. |

| 3 | Example assumes the purchase price is the market value of a metropolitan residential property. |

| 4 | Plus interest and costs. |

| All applications for credit are subject to Beyond Bank’s credit assessment criteria. Terms and conditions are available on request. Fees and charges apply. This information is available on our website at beyondbank.com.au/about-us/corporate-governance/disclosures, by calling us on 13 25 85 to request a copy or by visiting a branch. | |

| This information is of a general nature only and does not take into consideration your objectives, financial situation or needs. The information must not be relied upon as financial product advice. Before acquiring any product you should read the relevant guides, Product Disclosure Document, and consider whether a product is suitable for your circumstances to decide if a product is right for you. | |

| All products and services are provided by Beyond Bank Australia Ltd, 100 Waymouth Street, Adelaide, SA 5000, ABN 15 087 651 143 AFSL/Australian Credit License 237856. © 2025. |