BEYOND BANK AUSTRALIA LIMITED

(ACN 087 651 143)

At the conclusion of the 2024 Annual General Meeting of Members (AGM), two directors of Beyond Bank Australia Limited (Beyond Bank) retire by rotation in accordance with Beyond Bank’s Constitution.

There will be two vacancies on the Beyond Bank Board for which members are invited to nominate. Retiring directors Ms Joanne (Jodie) Baker (current Chair of the Board Risk Committee (BRC)) and Mr Daryl Johnson (member of the BRC and the Board Governance and Remuneration Committee) both offer themselves for re-election.

Director Joanne (Jodie) Baker

Current Chair of the Board Risk Committee.

Ms Baker was first appointed to the Beyond Bank Board in November 2017. Ms Baker’s second term as an elected director ends at the conclusion of the 2024 AGM, and being eligible, she offers herself for re-election. Ms Baker has over 30 years of leadership and experience in corporate and investment banking, stockbroking and funds management. Ms Baker has made valuable and significant contributions to the work of the Beyond Bank Board and as Chair of the BRC, specifically in relation to the application of a strong risk management focus on strategy development, digital innovation with experience as a fintech Chief Executive Officer, and strong corporate governance leadership. She is also a member of the Board of Export Finance Australia and CareFlight. Ms Baker resides in New South Wales.

Director Daryl Johnson

Member of the Board Risk and Board Governance and Remuneration Committees.

Mr Johnson was first appointed to the Beyond Bank Board in March 2019. Mr Johnson’s first term as an elected director ends at the conclusion of the 2024 AGM, and being eligible, he offers himself for re-election. Mr Johnson has over 30 years of leadership and experience in in the financial services sector including as a CEO and non-executive director in Australasia. His extensive experience encompasses senior executive roles across business private, consumer finance and retail banking. Mr Johnson has made valuable and significant contributions to the work of the Beyond Bank Board and as a member the BRC and BGRC, specifically in relation to the application of strategy development, people leadership customer experience and financial performance. He is also a member of the Board of Cuscal Limited, a core services provider of payments solutions and Credit Corporation (PNG) Limited. Mr Johnson resides in Victoria.

Board Composition and Competencies.

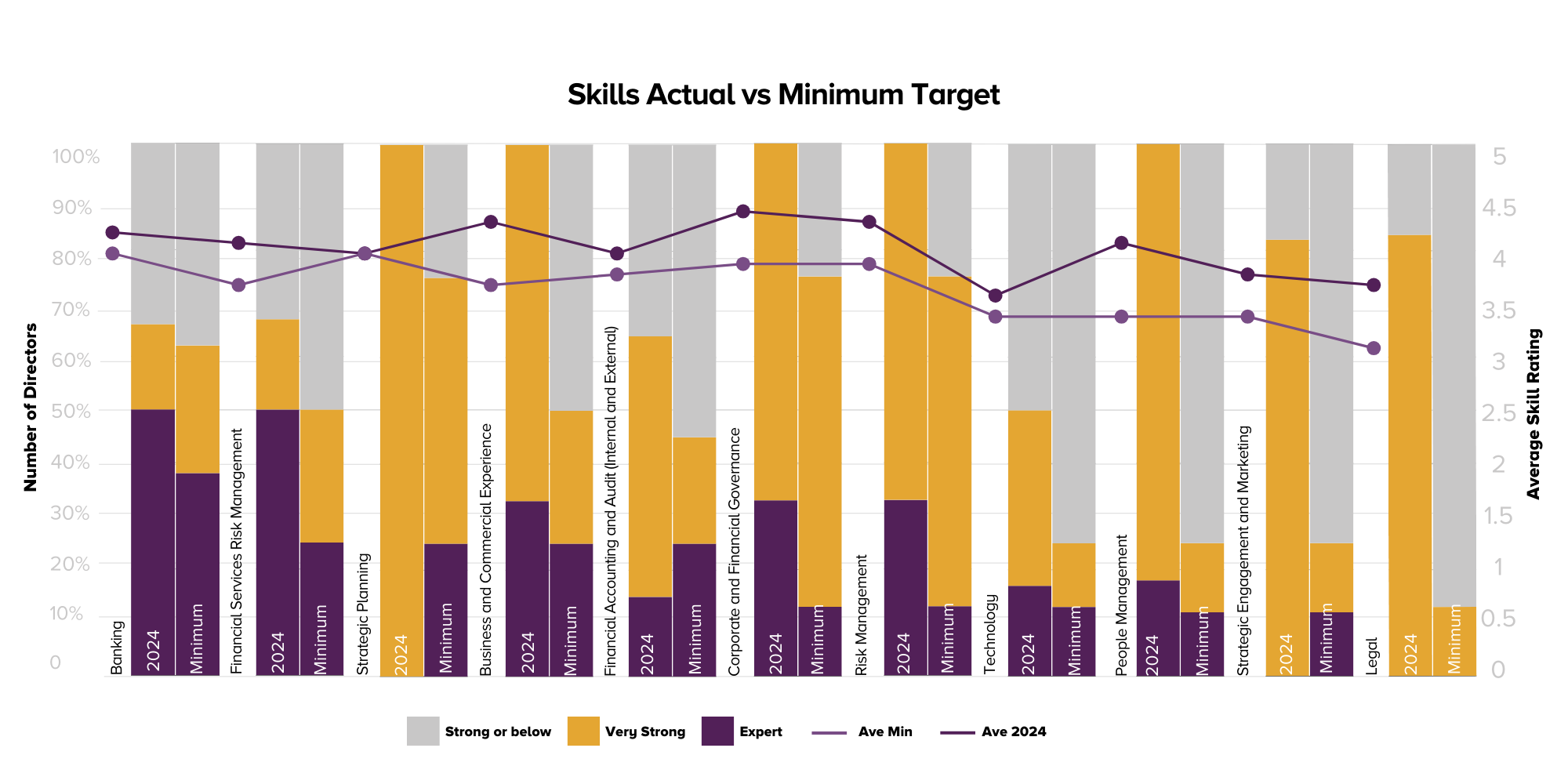

The Directors have again critically reviewed the structure, composition and competencies of the Beyond Bank Board and its individual directors. Our peer-rated assessments of the skills and competencies indicate that the Beyond Bank Board is collectively and individually rated as ‘expert’ or ‘very strong’ in the core requirements of boards of banks of a similar size and complexity; and is confident that the requirements of our regulator, the Australian Prudential Regulation Authority (APRA), are being met in the composition of the current Board.

With Beyond Bank’s assets now in excess of $10B, as it heads towards a more complex regulatory position of a Significant Financial Institution, the Nomination Committee must be mindful that Directors will be required to meet those higher requirements. Having an eye to the future tenure of directors joining a Board of this nature, we would envisage that Directors would be required to have that stronger skillset.

The chart below shows the results of the skills and competencies of Beyond Bank’s Board assessed during a review completed in 2024. Our assessment highlights the need to ensure the key skillsets of banking and risk management are retained at expert levels. Accordingly, our call for nominations is targeted to these key skillsets and candidates of the highest calibre are sought.

Requirements for Nomination

The Board of Beyond Bank is skills-based and is committed to maintaining a mix of directors that collectively bring the required experience and skills to enable the Board to operate efficiently and effectively. APRA has advised its regulated entities of the importance of corporate governance and the need to ensure that directors possess sufficient skills and experience to ensure they will properly perform their duties.

Members considering being nominated need to be mindful that Beyond Bank is a significant financial services organisation, which operates in the mutual sector and its Board strives to ensure a mix of highly skilled and experienced directors to ensure its governance is fit for purpose. As part of the Nomination Committee’s assessment process at this election, the focus will be on candidates that, at a minimum, possess highly developed skills and demonstrated experience in the required skill competencies of corporate governance, mutual businesses and strategic planning, and financial accounting and audit in financial services, together with two or more of the following areas: banking and financial services, risk management, financial reporting and analysis, business and people management, business strategy and planning, and technology skills.

Fit and Proper

Beyond Bank, being an authorised deposit-taking institution (ADI), is subject to APRA’s Prudential Standard CPS 520 Fit and Proper (F&P Standard). The F&P Standard sets out the minimum requirements that ADIs must apply in determining the fitness and propriety of individuals who hold positions of responsibility with the ADI which includes directors.

For the purposes of determining whether a person is fit and proper to hold a responsible person position, the criteria include whether the person possesses the experience, skills, competence, character, diligence, honesty, integrity, and judgement to perform properly the duties of a director.

Financial Accountability Regime

The Financial Accountability Regime (FAR) was introduced in September 2023, replacing and expanding on the Banking Executive Accountability Regime (BEAR) that had been in place since 2018.

FAR imposes a strengthened responsibility and accountability framework for entities in the banking, insurance and superannuation industries and their directors and senior executives. The FAR recognises that it is the actions of the directors and the most senior and influential executives within a business that shape the conduct of the business itself. Improving accountability within the business, therefore, requires strengthening and clarifying individual accountability.

A director’s appointment will be subject to APRA registering the successful candidate as an accountable person.

Corporations Law

Beyond Bank is also subject to the requirements of the Corporations Act 2001 (Cth) (Corporations Act) which, together with a number of common law obligations and prudential requirements, imposes specific duties and significant responsibilities and accountability on directors.

Nomination Process

In accordance with Beyond Bank’s Constitution, every candidate must submit to an interview by the Nomination Committee. The Nomination Committee for Beyond Bank is established under its Constitution and includes two independent governance experts. The role of the Nomination Committee is to assess each candidate and determine whether it is satisfied that the person is fit and proper and, as part of this assessment, has demonstrated an ability to be a director against the Model Criteria and Board Skills and Aptitudes Matrix.

It would be prudent for any member considering whether to be nominated to acquaint themselves with the duties imposed on directors by the general law and by the Corporations Act, and also Beyond Bank’s Constitution accessible on the Beyond Bank website at www.beyondbank.com.au

Members requiring more information, or a copy of the nomination pack, may obtain it from the Group Company Secretary, Wayne Matters, by emailing companysecretary@beyondbank.com.au

Nominations close at 5:00pm (ACST) on 21 July 2024.

Wayne Matters

Group Company Secretary